Jobs are lost, emergencies happen, medical attention is required, the list goes on. Sometimes, it’s a slow decline while other times things happen fast. Either way, more and more people are getting into situations where they need quick influx of cash through personal loans, and for finance-related websites, personal loan affiliate programs can be a way to connect companies with clients, and earn some really nice commissions for doing so.

The good news is that while banks will turn these people away, there are independent companies and lenders that will take on the perceived “risk” of people with low credit and offer them the funds and accessibility they need.

Even if your credit score is solid, you may end up needing a personal loan to get some things taken care of like an unexpected home repair, or perhaps a business/investment opportunity.. The world of finance and lending money is a big one, meaning there is a lot of room for earning potential.

If this is an area you’re invested in, it might be worth partnering with some personal loan affiliate programs and generating income from your know-how.

Personal Loan Affiliate Websites

When it comes to creating your website, you want to narrow down your target audience. This particular niche has fewer options than many others, but it’s still an important step nonetheless. You can start with the obvious – those with poor credit scores looking to secure a personal loan.

The Funding Company and Avant are only two of the many companies that offer loans to people with poor credit.

You can also choose to target a more specific group of people as their needs may vary from the general public. College students, for example. Many students have little to no extra money on hand, meaning many life-changing purchases are out of the question without assistance.

This includes cars, computers, and even accommodations. Boro is a personal loan company with a focus on college students – they know what their needs are and how to best meet them.

Lastly, you can cater to those who are still in the beginning stages of looking for a loan, and deciding if it’s actually a good decision for their specific situation. For example, maybe they don’t need a loan and just need to smartly budget for a few months to save the money they need.

Companies like Dr. Credit and Nationwide Loan Consultants provide plenty of education, information, advice, and guidance when it comes to loans and all things related. Research and comparison is an important part of the process.

Becoming an affiliate marketer is a fantastic way to build some passive income streams, and personal loan programs are a perfect way to do it well. Depending on the program you join, some offer affiliates a percentage of all loans that are given out.

That means you could be earning hundreds or even thousands from one customer, depending on how much they receive. The earning potential is incredible.

Personal Loan Affiliate Programs

- Max Cash

- Dr. Credit

- The Funding Company

- Boro

- Avant

- Mariner Finance

- Nationwide Loan Consultants

- Quicken Loans

- Private Loan Shop

- First Financial

- Lend Up

- Money Key

1.Max Cash

Max Cash is a loan referral service that can point you in the direction of the best possible loan for the circumstances you’re in. They take all the information about what you’re looking for and tell you which lenders will be most likely to give you what you want.

The best part is, it’s absolutely free for the borrower. Lenders pay Max Cash a fee, but it’s not added to the loan you receive. They have a comprehensive screening process and only partner with the best lenders in the industry.

They offer affiliates between 5-10% of the funded loan amount that the customer they refer takes out. Payouts can reach hundreds of dollars, leaving affiliates with incredible earning potential.

2. Dr. Credit

Dr. Credit is the perfect solution for those who have bad credit they want to repair. Dr. Credit offers a wide array of services and options. They have loans for credit scores of any state as well as both secured and unsecured loans. Their personal loans can be for any purpose.

In addition to helping you find the best and most suitable loan possible, they also have a personal loan blog where you can find many helpful resources and information. They will also handle debt consolidation and credit cards.

Their affiliate program is two levels deep. You’ll receive a per-lead commission on completed applications, and 15% on sales generated by those who you introduce to the affiliate program.

3. The Funding Company

The Funding Company offers easily accessible, unsecured loans with high approval rates. They require no income docs, no collateral, and no employment verification. This means you might end up with a higher interest rate, but it gives anyone easy access to up to $250,000 when they really need it.

They analyze your credit profile and help you find the best lending institution for your situation. Their expertise will help you avoid mistakes, disapproval, and extreme interest rates – all of which will hurt you and your credit more than necessary.

Affiliates have incredible earning potential, with payouts as high as $10,000 depending on the loan amount their referral receives. Commissions are also paid immediately upon funding, differing from the sometimes long wait times of other programs.

4. Boro

Boro is more than a lender. They aim to provide affordable and accessible loans to those who need it – with a focus on college students. Their services don’t end once money has been lent, however.

They partner with their customers and walk the financial journey with them. They provide suggestions, guidance, and advice. When giving out their loans they look at more than just credit score. They consider background, education, and, banking, and earning potential. They work hard to help and satisfy everyone.

Their affiliate program focuses on three categories of borrowers – college students looking for cars, college students looking for other “big-ticket” items, and those simply looking for advice and options. What you promote will depend on your audience.

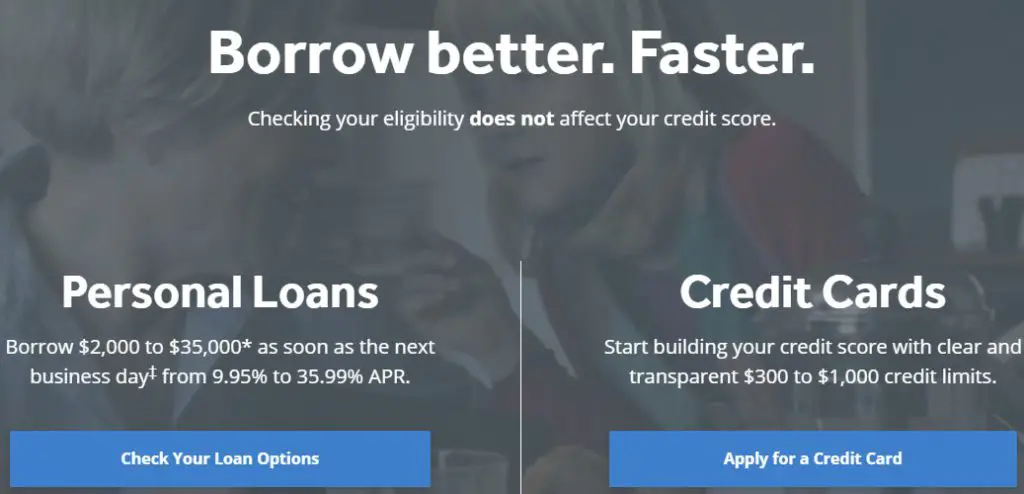

5. Avant

Avant offers small, accessible personal loans up to $35,000. You can, potentially, have your money as fast as the day after applying. Another great thing about Avant is that you can simply check your eligibility without affecting your credit score.

In addition to personal loans, they also offer credit cards with low limits for people who are struggling to get approved and need to build their credit. They offer $300-1000 limits.

They offer affiliates “competitive” commission rates with monthly payouts.

6. Mariner Finance

Mariner Finance offers a variety of loans, including personal. These loans can be used for anything from vacations to emergencies. They offer both secured and unsecured loans. Both of these offer a fixed monthly payment and a fixed interest rate, making it easy and predictable to manage expenses.

In addition to personal loans, they also handle debt consolidation, car loans, and home loans. They pride themselves on responding and acting quickly as they understand some situations are time-sensitive. They also provide borrowers with information and resourced to help them be as informed as possible.

The affiliate program is straightforward, offering monthly payouts for any funded loans an affiliate refers to the site.

7. Nationwide Loan Consultants

This company doesn’t directly provide loans, but they give potential borrowers all the help, guidance, and advice they might need when looking for a loan. They have professional consultants on hand 24/7 to address concerns and issues right away.

They will provide customers with a complete and comprehensive analytic financial overview with all the information they’ll need. Their advice has not only helped people find loans but allowed them to avoid mistakes and even bankruptcy.

Their affiliate program is straightforward but so lucrative that some are able to make a career out of promoting the program.

8. Quicken Loans

Quicken primarily offers loans for the purchase of a home, but has options for consolidation and refinancing as well. They have a refinance guide to get you started if you’re unsure how it works or what’s best for you.

They also have a lot of other educational content through their learning center which contains a series of articles on many different topics. Content includes information on mortgages, taxes, insurance, homeownership, and more.

Affiliates are given access to standard links and banners for their website as well as rate calculators and tables to give readers something to look at before going to the website.

9. Private Loan Shop

Private Loan Shop prides itself on being one of the fastest and easiest online loan providers. They offer personal loans, installment loans, and payday loans. You can apply online from either a computer, tablet, or even a mobile phone.

The loans are completely secure and accessible. All you need to get started is to fill out the online form and you can have cash in no time – they cater to everyone with loans of $500-35,000.

Affiliates are offered $0.50 per lead. In order for a lead to be generated, all the person needs to do is correctly fill out the online form – they don’t even need to be funded for the affiliate to earn the money. On a loan-themed website with lots of traffic, this can become extremely lucrative.

10. First Financial

First Financial provides many different kinds of loans to high-risk borrowers with poor credit. There are many companies that offer loans to people with poor credit, but First Financial has everything in one place.

You can get personal loans, cash advances, credit cards, business loans, merchant services, and ATM services. It’s the perfect solution for anyone looking for more than one thing at once, and a great program to promote as it will cater to many people.

Affiliates will earn a commission for every lead generated.

11. Lend Up

Lend Up is dedicated to providing those with poor credit an affordable and accessible way to rebuild and become financially healthier. There are so many Americans who can’t get a regular loan from their bank because their credit score is too low. Often, this causes them to resort to options that are less than ideal with astronomical interest rates.

Lend Up wants to change this and provide a better, more reasonable, and more affordable service. They offer loans to those who can’t get approved elsewhere. They also have accessible credit cards with low limits to allow people to build their credit back up. It’s these types of programs that are going to help people get back on their feet.

Their commission rates for affiliates are negotiable depending on the capacity and quality of your traffic, but they boast “competitive” payouts for all with a standard 30-day tracking cookie.

12. Money Key

Money Key provides short-term, unsecured loans and lines of credit to those that struggle to get a loan elsewhere. While easier and more accessible than banks, their platform is safe and secure. They are dedicated to customer service and ensure everyone is treated with respect.

They will also work with a customer even in states where they are not a direct lender, to find them a lender that will work for them – this is how passionate they are about their customer happiness.

The affiliate program boasts high commissions and high conversion rates. They also provide dedicated support to all affiliates and custom advertising content upon request.