Tax affiliate programs are always going to be lucrative. Especially at the end of the year when people start thinking about tax preparation. Sales continue to be high until the deadline in April to file tax returns.

Tax Industry Insights

- The tax preparation industry is worth an estimated $11 billion.

- There are an estimated 1.2 million tax preparation services in the USA.

- Tax debt is valued at $527 billion.

- 627,000 is the estimated number of business start-ups annually. Many could benefit from entity formation services.

Every one of those sectors listed above has suitable tax affiliate programs. Tax prep software and tax planning services are two examples, including affiliate programs for company formations, tax resolution, and IRS debt relief services.

Given that the average tax refund in 2019 was $3,000, it’s no wonder why tax preparation is so competitive. It is something everyone ought to pay attention to because it is their money, not free money.

To get it right though, tax preparations need to be done carefully and every deductible accounted for to make sure the money owed is returned.

Tax Affiliate Website Ideas

- Focus on tax debt relief, either on a devoted niche website or as an addition to a tax advice magazine, blog, podcast or video channel,

- Concentrate on the startup market, perhaps niching down to different sectors such as software business startups, starting a landscaping business, setting up a hair salon, etc.

- Teach people the intricacies of running a business and recommend outsourcing accounting services so they can do more of what they’re good at and less of what they’re not!

- Focus on one aspect of the tax industry such as payroll or bookkeeping. Even narrower would be payroll for real estate agents or dentists, for examples.

- Who knows, you may even be able to build a finance blog in Spanish and refer people to Hispanic tax preparers and other tax professionals who speak Spanish.

12 Tax Affiliate Programs

- Turbo Tax by Intuit

- Tax Slayer

- Finance Pal by Community Tax (or join both affiliate programs)

- Liberty Tax

- Tax Act

- Inc Authority

- Patriot Software

- 97 Tax

- Tax Jar

- Tax Goddess

- Curadebt

- E-File

1. Turbo Tax

Turbo Tax is likely America’s most popular tax prep software and it is part of the Intuit range of accounting software which includes Quickbooks.

As of 2020, the company has over 30 million users filing their tax returns using the Turbo Tax software. A few plans are offered and like many of their competitors, they offer a free plan, albeit with very limited use.

A premium plan is needed to file any tax return with deductions of any sort, be that for alimony, health insurance, or student loan repayments.

The software makes it easy to find every tax-deductible to use for accurate tax reporting.

One deductible that’s often overlooked is charity miles. Turbo Tax have an app called ItsDeductible, which is handy for tracking charitable donations throughout the year, helping to maximize the amount customers get back in their tax refund.

The affiliate program is managed by Commission Junction, uses a 7-day cookie, and pays up to 15% commission on sales. The program is open to US and Canada Publishers.

Sign up for the Turbo Tax Affiliate program

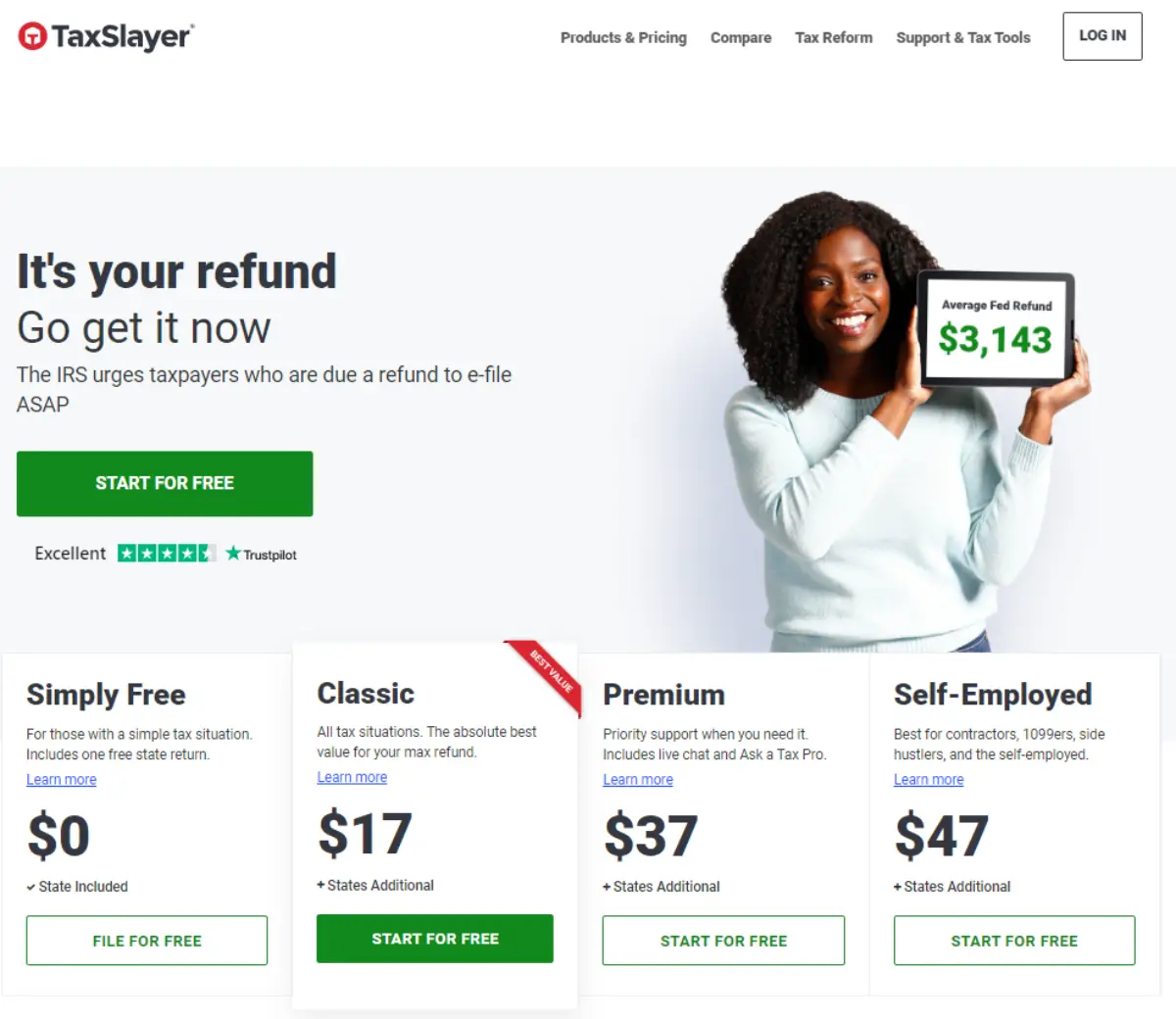

2. Tax Slayer

Tax Slayer was founded in 1998 starting out with the traditional tax filing service. Naturally, they have moved with the times to provide an e-filing service for federal and state returns.

The software has gone through some radical changes in recent years to make the filing process simpler, more efficient, and increase accuracy.

One of the neat additions to the software is the ability to import the previous year’s W-2 form to jump-start the form filling process.

Like e-file.com, they also give users the option of a quick file or the traditional approach of going through each stage with a fine tooth comb.

They also give an accuracy guarantee similar to the Tax Act software, just not as high. If inaccurate information results in federal or state penalties, they’ll reimburse the fees plus interest charges.

The Tax Slayer affiliate program is managed by Commission Junction, uses a 90-day cookie, and pays a 25% commission on sales.

Sign up for the Tax Slayer affiliate program here.

3. Finance Pal

Finance Pal was founded in 2010 as a sub-division of Community Tax, which specializes in tax resolution services.

The company is an accounting agency suited to small to medium-sized businesses that need to outsource all or part of their accounting processes.

Tax services available include:

- Accounting

- Bookkeeping

- Payroll

- Sales tax

- Entity formations

- Tax preparation

Finance Pal use Commission Junction to manage the affiliate program. Commissions are $15 per lead (free trial registration), and $450 per sale with the potential of bonus commissions up to $1,000.

Register for the Finance Pal affiliate program on CJ.com.

The parent company – Community Tax – also has an affiliate program. Apply to that here.

4. Liberty Tax

Liberty Tax is one of the largest tax preparation franchises in the US with over 3,000 branches spread across all 50 states.

Hundreds of those branches have Hispanic speaking tax preparers, which is the 2nd most spoken language in the country.

Liberty Tax uses Gen3Marketing to manage the affiliate program and they use Commission Junction so you can sign up for the Liberty Tax affiliate program on CJ.com.

Registration, like many tax prep services, is free to use but payment is required for filing. Some of the tools available include:

- A tax organizer

- Tax calculator

- Mileage log

- W-4 withholdings calculator

Commissions are 5% per sale and they use a 45-day cookie.

Sign up for the Liberty Tax affiliate program here.

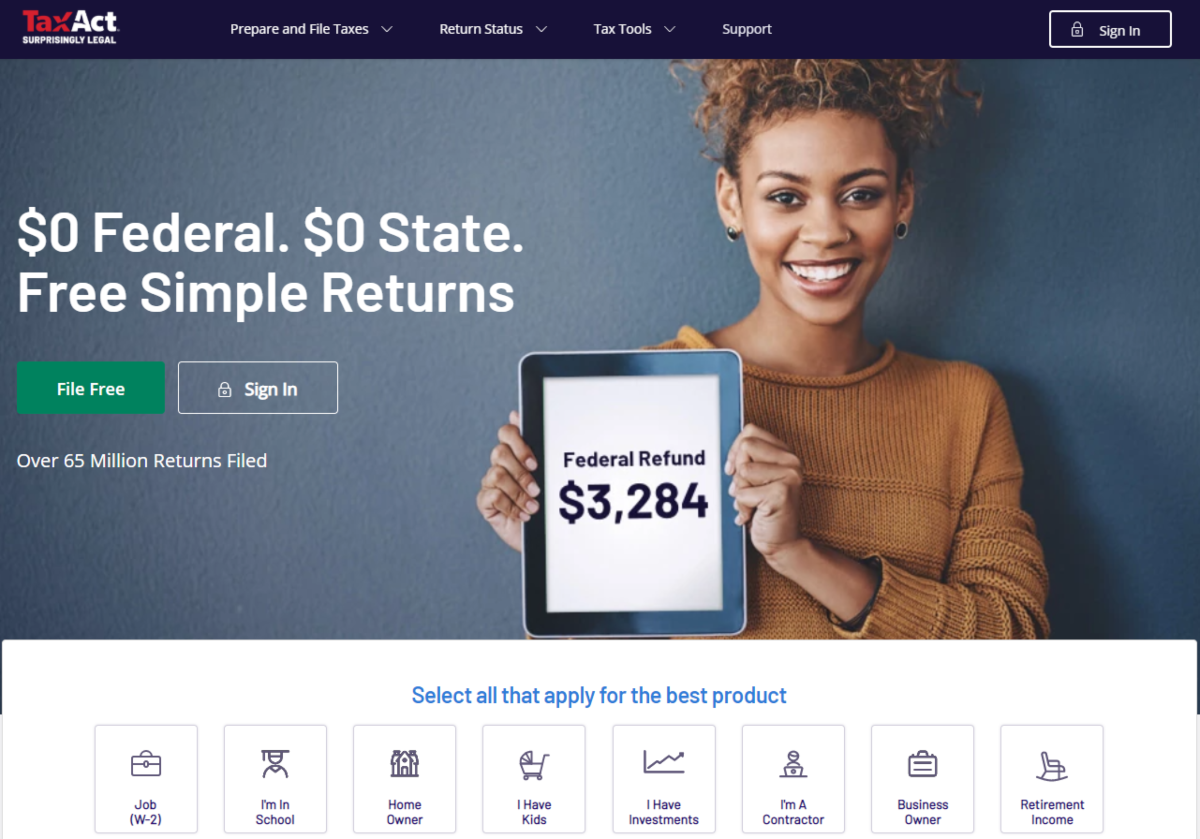

5. Tax Act

Tax Act is one of the largest e-filing services on the market. In comparison with competitors, pricing is mid-range and that reflects the middle-market position.

What the service lacks in premium features such as the ItsDeductible app from Intuit’s Turbo Tax software, it makes up for it for with accuracy.

Tax Act guarantees 100% accuracy. If a tax return is filed and doesn’t result in the maximum tax refund or higher tax liability, the company will refund the cost of the software and also pay the difference between what you got and what you should have got, up to $100,000.

The Tax Act affiliate program is managed on Commission Junction, uses a 45-day cookie, and pays a 15% commission. Dedicated affiliate support is provided and you can also negotiate a private commission structure so you can offer a discount to your readers.

Sign up for the Tax Act affiliate program here.

6. Inc Authority

Inc Authority specialize in business formation services.

They offer free services with optional add-ons recommended throughout the setup process.

Some upgrades include:

- Operating agreements

- A company record book

- Ownership certificates

- Company seal

- Minutes and resolutions to help new business owners stay compliant with federal and state guidelines.

There are also a few premium bundles of business start-up services that can be ordered depending on the services needed, which may be beneficial to startups needing a business license report or business credit included.

Inc Authority uses the Shareasale.com network, pays $80 commission per sale, and uses a 30-day cookie. Commissions can rise to $100 for higher volume sales.

Sign up for the Inc Authority program here.

7. Patriot Software

Patriot Software is a cloud-based accounting and payroll software. Pricing is among the most affordable for full-service payroll starting at $30 monthly, then $4 for each additional employee.

The software makes it easy for small business owners to file the right tax forms with the right tax agencies at the right time.

The Patriot Software affiliate program uses the Shareasale.com network with support provided by Advertise Purple. They pay $20 per lead, use a 90-day cookie, and have a coupon that gives your customers a two-month free trial.

Without your coupon, new users can only get a one-month free trial so there is an incentive for your referrals to use your coupon.

Sign up for the Patriot Software affiliate program here

8. 97 Tax

97 Tax is an accountancy firm based in Florida that specializes in IRS applications for state payment plans and arranging the removal of tax liens.

The reason they focus solely on this area is that the process needs attention to detail. Tax liens are serious and often need tax professionals to advise and assist with working with the IRS to arrange monthly payment plans.

Until a tax lien is removed by the IRS, credit scores are lowered, and that affects household finances.

If you have a finance website focused on either personal finance or debt relief, the 97tax.com affiliate program could be a good fit.

The affiliate program is listed on Shareasale.com, uses a 90-day cookie, and pays a $47 commission per sign-up.

Sign up for the 97 Tax affiliate program on Shareasale.com

9. Tax Jar

Tax Jar provides is a SaaS product for sales tax management. The software brings sales tax data from online marketplaces such as Amazon, Etsy, and eBay into one dashboard making it easier for online sellers to collect and report sales tax data.

Since the introduction of economic nexus laws in 2018, there are now 10,814 sales tax jurisdictions across the US. For online retailers, especially those selling on multiple marketplaces, the software could be considered a must-have.

The Tax Jar affiliate program pays a 20% commission for the first year’s revenue with higher rates available based on sales performance.

Ideal partners are financial service companies, tax advisers, and technology partners who could use their API to integrate sales tax management into other financial software products.

Apply to join the Tax Jar affiliate program here.

Tax Goddess is a CPA firm that’s owned and managed by Shauna Wekherlien who is a Certified Tax Coach. Among the team are accountants, bookkeepers, and tax strategists.

The company is based in Arizona and has been operating for over 12 years.

DropMyTaxes is their flagship product and to date, the company have saved its clients a collective $296+ million and counting.

The Tax Goddess affiliate program pays 20% commission on sales as well as a 2-tier opportunity to earn more and bonuses up for grabs too.

Bonuses:

- Sell 5 plans, you get a $100 gift card,

- Sell 10 plans, you get a $250 gift card,

- Do 50 sales in a quarter and they’ll put you up in a hotel in Vegas for a week and give you a $250 gift card.

No details are provided about the cookie tracking but the affiliate program is managed in-house, has a private Facebook group just for affiliates and marketing materials provided.

Apply to the Tax Goddess affiliate program here.

11. Curadebt

Curadebt is a top-rated tax debt relief company. They’re one of the few to provide transparent flat-fee pricing to assist with tax debts over $10,000.

Statistics from 2018 showed 14 million Americans were in debt to the IRS to the tune of over $131 billion. Many of those will have debts in excess of $10,000 and need assistance from a tax debt specialist.

The service from Curadebt offers a number of solutions including

- Negotiating for an Offer in Compromise

- Installment agreements

- Penalty abatements

- Assessing the debts owed as if any are over 10-years, a Collection Statute Expiration Date (CSED) could be applied to make some of the debt non-collectible, or in cases of extreme hardship, IRS debts could be categorized as Currently-Non-Collectible” (CNC).

The Curadebt affiliate program has a number of ways you can earn including pay per call, per-lead, or per sale as well as a 2nd tier that pays 10% commission made by affiliates you refer.

The commission structure for tax relief are:

Per lead: $40. For a lead to qualify, they need to have over $10,000 in tax debt and confirm their phone number. If they go on to enroll in the service, you qualify for sale commission too.

Per Sale: $200. This also applies to leads you send who enroll who don’t confirm their telephone number using the automated system.

Per call: $60 to $80 depending on how long your lead stays on the phone.

There are two automated pre-screening questions used to confirm the lead is valid. The first question is to confirm the person has a minimum of $10,000 in tax debts and the second is to confirm they have a monthly income to afford monthly repayments.

For calls lasting over two minutes but under 30 minutes, affiliates are paid $60. The commission increases to $80 when the call lasts over 30 minutes.

To use the pay-per-call program, you need to sign up on Commission Junction or Shareasale.com.

Once registered on one of those networks, you’ll get a toll-free number to use in your campaigns.

The 2nd tier commissions pay 10% on both leads and sales commissions generated by sub-affiliates.

Sign up here for the Curadebt affiliate program

12. E-File

The E-File.com website makes it slightly easier to file tax returns online. They offer free and paid plans, but the free plans only apply to filing Federal tax returns. To file a state tax return, a premium plan is needed.

The average prices are $20 and $40 depending on the type of filing customers need. The higher priced $40 (avg) will be needed for filing itemized tax deductions.

Like most tax software providers, discounts are often applied at the end of the year when people are needing electronic filing services as the deadline approaches.

The affiliate program uses a 120-day cookie and pays $1.40 for those who choose the free plan and a 40% commission on sales on any of the paid plans.

They are open to working with coupon affiliates and those running loyalty websites, for which they offer co-branding opportunities too.

The affiliate program for E-file.com is available on Commission Junction, Affiliate Window, and Link Connector.

Registration details for the E-File affiliate program are listed here.