For those in the personal finance industry, credit repair affiliate programs have tremendous earning potential. Especially during an economic downturn.

In the finance industry, demand for credit repair services goes the opposite direction of the economy. A study by IbisWorld.com showed demand fell from 2014 to 2019 and that’s because people had higher disposable income and unemployment rates were lower and relatively stable.

When unemployment rates rise, disposable income falls and that’s when people turn to credit, in particular, to find ways to switch providers, consolidate loans, re-mortgage, and/or release equity from their homes at better interest rates to lower their monthly payments.

But, even in good economic times, credit repair still remains important because the higher a person’s credit score is, the lower risk a person is considered to be by lenders and that helps access favorable interest rates on finance.

The vast majority of lenders (90%) use FICO scores to assess credit risk. A 700 credit score is considered good and anything under that can be considered sub-prime – the term used by finance companies to describe services for people with a bad credit rating.

The goal for credit repair services is to increase credit scores to 700+.

The difference in a credit score leads to higher or lower interest rates on all types of finance including mortgages, auto loans, any type of secured loan, credit cards, and student loans.

Having a mix of different types of credit and continually making timely payments also increases credit scores.

For that reason, if you’re in the personal finance space, whether using credit card affiliate programs, providing mortgage advice, secured loan comparisons, or publishing advice to students to manage student loans… credit repair affiliate programs could be your ticket to provide better help and increase your earnings too.

Credit Repair Affiliate Website Ideas

- Credit card affiliates can break down offers between prime cards and sub-prime cards for people with low credit scores.

- Immigration advice blogs, services and ex-pat blogs can refer people to credit building services to build a credit score.

- Business coaches and those providing advice about business start-ups or promoting business plan affiliate programs can go a step further and refer people to business credit building services.

- Debt consolidation is another area that can be helpful for repairing credit and lowering monthly payments.

- If you have a software review website, there are credit repair software programs suited to both individuals and for commercial use.

- Credit reports can only be obtained by individuals, not the companies offering credit repair services. A lot of companies provide free access, then monetize the service in the back-end with a credit matching service with some firms paying affiliates per lead, even for the free credit scores.

12 Credit Repair Affiliate Programs

- Credit RX America

- Nav.com

- Lexington Law

- Reliant Credit Repair

- Upstart

- Credit Sesame

- Self.inc

- Dispute Bee

- MyFico

- CreditFirm.net

- Tradeline Supply Company

- Credit Saint

1. Credit RX America

Credit RX America is a rare find because they’re a young company, family-run and customers only pay for results. It should be noted that the results are not based on an improved credit score. They’re based on paying per deletion of negative entries.

Currently (mid-2020), they’re offering a free credit audit. Some credit repair companies are charging upwards of $200 just for an audit, without doing anything with it.

The credit audit lets customers know what’s dragging their credit scores down and gives people advice on what could be removed leaving it up to the customer to decide how many deletions they want to focus on. The pricing is transparent at $99 per deletion.

The affiliate program is privately run and they’re paying 15% of the gross revenue they make from referrals.

The ideal partners they’re looking for are other businesses such as realtors, mortgage brokers, financial planners, and tax preparers. That is their ideal partner though but anyone with a website in the finance space could be a good fit. So, if you think you may be, it’s worth a discussion about partnering.

Apply here to the Credit RX America affiliate program

2. Nav

Inaccuracies on credit scores aren’t limited to consumers. They’re a major pain for small businesses too. Consumer credit scores can be accessed for free from a variety of sources but access is restricted to only people with a reason, such as when you apply for credit.

Business credit scores differ in that they range from 0 to 100 with Dun and Bradstreet PAYDEX, 0 to 300 with FICO Small Business Scoring Service, and 224 to 580 with the Equifax Business Delinquency Risk Score – and those can be viewed by anyone without needing the company’s permission.

Nav provide free access to business credit scores and a range of tools to help small business owners build better credit lines. The business credit reports are graded and can then be used to match businesses to lenders based on their credit rating. They also provide tools to help businesses build better credit.

The Nav affiliate program is managed by Impact.com, uses a 45-day cookie and pays between $8 to $40 per signup.

Apply to the Nav.com affiliate program here

3. Lexington Law

Lexington Law is one of the longest-running credit repair law specialists in the industry. The company was founded in 2004 and over the years they’ve succeeded in helping thousands of customers get unfair and unsubstantiated information contained in credit reports deleted.

The service isn’t cheap, but the real value is having experienced paralegals do the tedious admin work to have items deleted. Plus, when you break down a monthly price for a service that would take hours to do, it is something people pay premium prices for.

Especially when they know they are hiring legal experts who are up to date on consumer finance laws.

Lexington Law is marketed by Progrexion and Commission Junction is used to manage the affiliate program. Tracking cookies are set to 30 days and the company pays a $65 one-time commission.

Apply to work with Progrexion to promote the Lexington Law affiliate program

4. Reliant Credit Repair

Reliant Credit Repair is based in New Jersey and has been operating since 2015. Similar to Lexington Law, which does everything they can legally, Reliant Credit Repair only challenges legitimate discrepancies rather than unscrupulous firms that challenge everything in the hope that something gets removed.

Several pricing plans are offered for consumers depending on how many disputes need filed. There’s also assistance for businesses to build better credit lines too.

In addition to providing a credit repair service, the company also provides credit counseling services, which is more or less just informing people about how the credit system works and navigating them towards better financial management in the future so they can keep their credit ratings in good shape.

The Reliant Credit Repair affiliate program is privately run and pays up to 40% commissions. No information is published about cookie-tracking or the software they use to manage the program.

Apply to the Reliant Credit Repair affiliate program here.

5. Upstart

Upstart.com is an AI lending platform that uses artificial intelligence for a more detailed risk analysis. The platform is suited to people with multiple credit accounts looking for a debt consolidation loan.

Loan amounts start from $1,000 rising to a maximum of $50,000. Most lenders use FICO scores to determine who gets approved for credit and the interest rate they’re charged.

Upstart examines credit reports in more detail to consider other factors such as an individual’s work experience and level of education to understand if they have higher earning potential.

By considering other factors beyond the credit score, Upstart tend to have a higher approval rate and with fairer interest fees. The only requirements for a debt consolidation loan is that applicants need to have a FICO score of 620 at least, and earn a minimum of $12,000 per annum.

For sub-prime borrowers, interest rates on credit cards and unsecured loans for scores in the 620 region are typically high, so there is potential to switch to a lender that’s known for fairer interest rates to save money while combining debts.

The Upstart affiliate program is managed by Impact.com and pays a 1% commission for each funded loan so the commissions will range from $10 to $500.

Apply to the Upstart.com affiliate program here.

6. Credit Sesame

Credit Sesame provides a free credit score and monitoring service and they also integrate a number of tools to help people understand and manage their credit reports.

The company makes its money in the backend by providing users with recommendations on suitable credit cards, auto loans, and other types of finance based on their personal credit scores by matching them with suitable lenders.

The affiliate program is managed by Tune.com (formerly hasoffers.com) but there aren’t any details published about how much they pay or cookie-tracking information. Other networks including FlexOffers.com and OfferVault.com have the commissions listed as $3 to $3.20 per lead.

To find out more about Credit Sesame’s affiliate program, contact the team at Tune.com.

To sign up, complete this application form for the Credit Sesame affiliate program

7. Self.Inc

Self.Inc used to be known as Self Lender and they are a fin-tech company that’s been around since 2014. They provide credit builder loans, which technically aren’t loans at all. They’re installment plans used to build credit by reporting to all three credit bureaus, provided the installments are paid every month, on time.

How credit builder loans work is a customer agrees to a loan amount, usually up to $1,000 and the money is paid in installments. The installments are placed into a CD (Certificate of Deposit) account and then released when the full amount of the loan is paid. It’s like lending yourself money, hence the name, Self Lender, now Self.Inc.

These accounts are suited to those with no credit, therefore needing to build credit, as well as people who have ruined their credit ratings through previous missed payments or accounts in default. They can also be beneficial for people who just want to build up an emergency fund who perhaps don’t have the self-discipline to continue saving.

The ideal customers are those with FICO scores below 600.

The Self affiliate program is managed by Impact.com, uses a 30-day cookie and pays $10 for each new account opened.

Sign up for the Self affiliate program on Impact.com here.

8. Dispute Bee

Dispute Bee provides credit repair software that’s suitable for commercial and personal use. Where the software helps is by automating and organizing files sent and received throughout the credit repair process.

Users can import credit reports, find factual discrepancies, and generate dispute letters to print and mail to the credit bureaus.

All the correspondence can be imported to the software too helping to keep each dispute organized so users have detailed records of everything being done to repair bad credit.

Where this could be helpful is for consumers taking the DIY approach to repair their own credit as they will have access to a database of dispute letters ready to complete, print, and send.

The Dispute Bee affiliate program is managed on the Tapfilliate.com network and pays a one-time commission of 35%.

Sign up for the Dispute Bee affiliate program here.

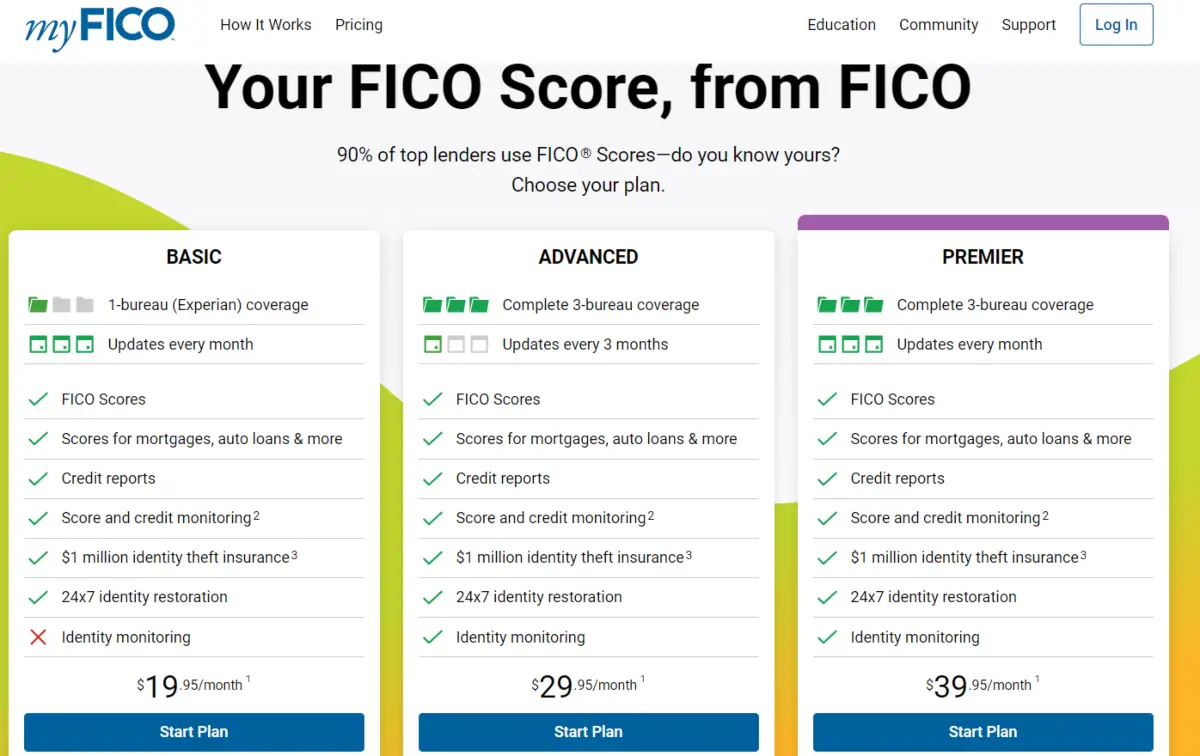

9. MyFico

Before anyone can start to fix bad credit, they need to have a copy of their credit reports, preferably from all three credit bureaus. MyFico is the website where customers can order single credit reports, packages, or subscribe to annual packages to monitor their credit reports.

It’s estimated that 90% of the top lenders in the US use FICO scores as part of their credit-checking process. For that reason, most referrals will be people preparing to apply for a considerable amount of debt who need to focus on raising their FICO score.

The MyFico.com affiliate program is managed by Shareasale.com, uses a 30-day cookie and pays $5 per sale of one bureau credit report, $10 for packages of credit reports from all three bureaus and for purchases of the Annual Three Bureau reports, used for credit monitoring, the commission is $100 per sale.

Sign up for the MyFico affiliate program on Shareasale.com

10. Credit Firm

Credit Firm is a licensed credit repair law firm specializing in consumer finance, but more specifically with expertize around the Fair Credit Reporting Act (FCRA).

The company has been in business for over two decades and in that time assisted over 80,000 customers in every state of the US to improve credit scores.

Being a law firm, the team’s expertise is suited to more challenging circumstances that affect those with severely impaired credit due to bankruptcies, tax liens, foreclosures, and repossessions among other serious derogatory information contained in credit reports.

More standard issues like removing late payments or charge-offs would be more affordable for people to do themselves. Where legal expertise is needed though, Creditfirm.net is positioned as the most affordable credit repair legal specialist costing $49.99 monthly, which is $30 cheaper than the lowest package offered by Credit Saint.

Like most credit repair specialists, they offer a free consultation which helps their team know if they’re in a position to help customers improve their credit score.

The Credit Firm affiliate program is managed on Shareasale.com, pays $20 per sale and uses a 180-day cookie.

Sign up for the Credit Firm affiliate program on Shareasale.com

11. Tradeline Supply Company

Tradeline Supply is NOT a credit repair company. They provide services that MAY help increase someone’s credit score fairly quickly but this isn’t something that’ll be suited to everyone.

For this type of program, marketers need to be careful with how they market these types of products because they cannot be marketed as a guaranteed way to boost credit scores.

With tradelines, it is a gray area because some people take the view that this is a deceptive practice because it’s misleading lenders about a potential customer’s true credit worthiness.

If you’re okay with that, so are others who are willing to pay to buy or rent a tradeline.

Buying a tradeline is the equivalent of piggybanking on someone else’s good credit rating by having them add someone as an authorized user. It’s the same strategy parents use to help their kids establish credit. They add them as an authorized user to their credit card but they don’t always give them access to it.

In the case of buying or renting tradelines, it’s the same practice, only adding strangers as authorized users. The primary purpose is to have the credit line reported to the main credit reference bureaus.

Tradeline Supply are one of the most affordable and reputable companies in the tradeline industry. Users sign up to sell their credit rating and people with poor credit looking for a cheap and potentially effective way to boost their credit score will rent the credit card profile to become an authorized user.

It’s important to note that buying a tradeline does not let people obtain credit from the credit card accounts they’re added to as an authorized user. The additional card is posted to the primary account holder.

Citi Bank, Wells Fargo, and US Bank credit cards can’t be registered here because they’re known to have a lower success rate at reporting to credit bureaus. The credit card accounts are restricted to credit card providers shown to have reliable reporting to the credit bureaus. Those include Barclays, Capital One, Elan, Bank of America, Discover, and Chase Bank.

TradelinesSupply.com accounts are guaranteed to be at least two years old and those will be the cheapest. Around 10% of a Fico Credit Score is directly attributable to the age of accounts. Older credit card accounts with a longer history will be more expensive.

The Tradeline Supply affiliate program is managed by Commission Junction, uses a 45-day cookie and pays 10% commission.

Sign for the Tradelines Supply affiliate program on CJ.com (Login and search for Tradeline Supply or advertiser ID:5164235

12. Credit Saint

Credit Saint is a credit restoration company that’s recognized as an industry leader. They have an impeccable A+ BBB rating, which is super important for these types of companies.

The main stand out feature and a huge selling point is that they are the only credit repair company to guarantee results or give a full refund if there’s no changes to a customer’s credit report within 90 days of subscribing to any of their packages.

To ensure they can honor their commitment, they do pre-screen applicants and only take on clients they’re confident they can help.

The services are productized meaning clients can choose from three levels of services, each having a different level of aggressiveness. At the most basic, five disputes are included per month. The higher priced packages offer more services to challenge cases that disproportionately affect clients’ credit scores.

Applicants who need specialist help to restore their credit rating can schedule a free consultation.

For those who qualify and decide to sign up, affiliates are paid a $150 commission. The affiliate program is managed by ShareaSale.com and uses a 90-day cookie.